20 Fundamental Criteria for High Growth Investing

I’d like to take a moment to outline the 20 or so primary fundamental metrics I typically utilize to assess the stability, performance and excellence of a company I may want to invest in. There are some terms I want to cover so that we are on the same page going forward. I try to think of the following terms in groups, as they typically go together:

- Investing…companies…fundamentals…long-term

- Trading…stocks…technicals…short-term

These terms and activities are VERY different. Confusing the two will eventually lead to catastrophic circumstances in almost ALL cases over the long-term.

First, it’s critical in stocks, accounting, finance and income taxes to understand that “long-term” refers to a time frame of at least one-year or more. “Short-term” refers to less than one-year. When investing in stocks, or any assets (like a house, building, land, tractor, car), the government also uses this criteria to determine if you pay long-term capital gains taxes on any realized gains of only 15-20%, or short-term capital gains taxes equal to your income tax rate, which has been as high as 42%. Clearly, if you can hold on to a stock or asset for a full year, it is extremely advantageous to invest over the long-term and pay much lower taxes on your capital gains (I will assume you are going to have gains if you are investing in great, fundamentally sound companies for the long-term!! ;).

Second,“fundamental” analysis of a company’s internal performance is the cornerstone of investing, and must be distinguished from “technical” analysis of a stock, which implies studying its price or volume graph over time. I “invest” in great, fundamentally sound companies; however, one might “trade” a stock day-to-day, short-term, and based solely on the technical analysis of its stock price or trading volume, and without necessarily any regard to the underlying fundamentals of the company that stock represents. (Remember that a stock price often does not represent the value of the company it represents…[STOCK DOES NOT EQUAL COMPANY]… a stock price can be much higher or lower than the value of the company depending on so many factors) Prior to “investing” in any company for the long-term, I first analyze that company’s performance, their financials, management team, and a plethora of other factors I will list below.

On the other hand, people who “trade” stocks short-term, usually look only at the graph of the stock price movement, the patterns that emerge in that graph, and other factors that are “technical” in nature and pertain to the stocks graph, highs and lows, volume or price and often are not based on the underlying “fundamentals” of the company (e.g. not based on its management team, performance, growth, profits, assets, debts, cashflow, product mix, strength of the company, competition, etc.).

To reiterate, I “invest” for the long-term and in solid “companies” with great fundamentals. I may occasionally use technical analysis of graphs, stock highs and lows, volume and other technical strategies to choose the timing of when to actually buy the stock of a company whose fundamentals I have researched and like, but conversely, I would never try to “invest” long-term in a company based solely on the stock price movements, graphs or other technicals.

If the fundamentals of a company are solid, I do not need to time my stock purchases exactly right. The stock price will eventually follow the superior performance of the company over time, if given enough time and with continued company growth. When I discover a solid company, I build a position in thirds, fourths, fifth…even 10th’s…over time. I don’t try to establish my entire position immediately in one purchase and I don’t stress over when exactly to get in. Its nearly impossible to time it exactly right. If I like a company’s fundamentals, I buy about ⅓ of the position I want to eventually have in the company. Consider Cloudflare (NET), for example: When NET is trading at $95/share the other day, or $200 next year, I’m not going to look back and regret whether I picked it up at $22, $25, $27 or $29. No rational person is going to think, “oh, I only got 7x my money instead of 8x because I failed to buy it at $22 vs $25. I’m just stoked I bought it at ALL those prices as I gained conviction in the company and built my position. And if you’ve done your homework and the fundamentals are great, you will have a LOT more conviction in your purchases and be able to disregard the day to day fluctuations in the stock price that often do not reflect the strength of the incredible company you own. A perfect example of this is DDOG and NET yesterday, who both had fantastic earnings, but were down this morning on the opening, presenting a great opportunity to add to your position if you were following it.

To be clear and recap: I strive to invest long-term in companies I have researched, rather than only to simply “trade” short-term in and out of stocks or options. If I do choose to make a short-term trade on a stock, I almost always have a firm grasp and solid understanding of the underlying company, its fundamentals and the roughly 20 major metrics list below. Those metrics include the following, but this is by no means an exhaustive list. Each company and sector will have a few of its own nuances, differences, idiosyncrasies and KPI’s (Key Performance Indicators) to track. I will strive to delve into each fundamental metric I use below and describe what I look for as I cover them in future posts:

20 Fundamental Criteria for Investing in high-growth companies:

- Rapid Revenue Growth (Q/Q & Y/Y); greater than 35% & accelerating

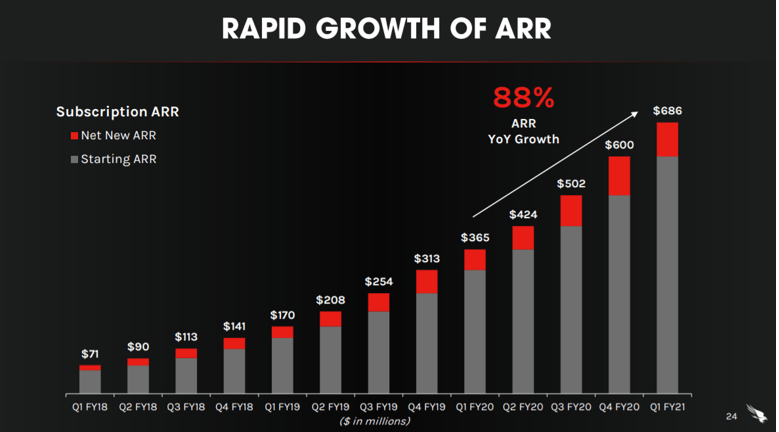

- ARR – Annual Recurring Revenue Model (usually subscription based)

- Company Size: Market Cap and Trajectory – Ability to 10x itself

- TAM (Total Addressable Market) & Runway – Ability to 10x itself?

- Customer Growth? Product growth? Geographical growth?

- Great Management – Honest, SH friendly, experienced, founder led

- Net Dollar Based Retention Rate min > 100%; prefer >120%

- High Gross Margins min > 50% – stable or increasing – Prefer 70%+

- Balance Sheet – Strong “going concern” (Strong Cash with little or no debt)

- EV/Sales – Understand this number is NOT created equal across companies

- Competitive Advantage: New technology…Leader…Moat…or a niche

- Improving Operating Leverage (Decreasing expenses to revenue ratio)

- Insider & Institutional Ownership (and founder led is a huge plus)

- Consensus: Motley Fool, Seeking Alpha, Bert, IBD, Institutional buying

- US based Company – No Chinese companies

- Minimal or limited Cap-Ex requirements – Ability to pivot quickly.

- Positive or rapidly improving CFFO and FCF

- Profitability or the ability to get there quickly

- Little or no competition unless they are the clear sector leader

- Increasing (hopefully rapidly) earnings (if not rapid revenue growth)

I will reiterate that this is by no means an exhaustive list, but covers many of the more critical KPI’s that I follow when investing in high growth, cutting edge companies. Much more about each one of these to follow. Cheers! – Poleeko