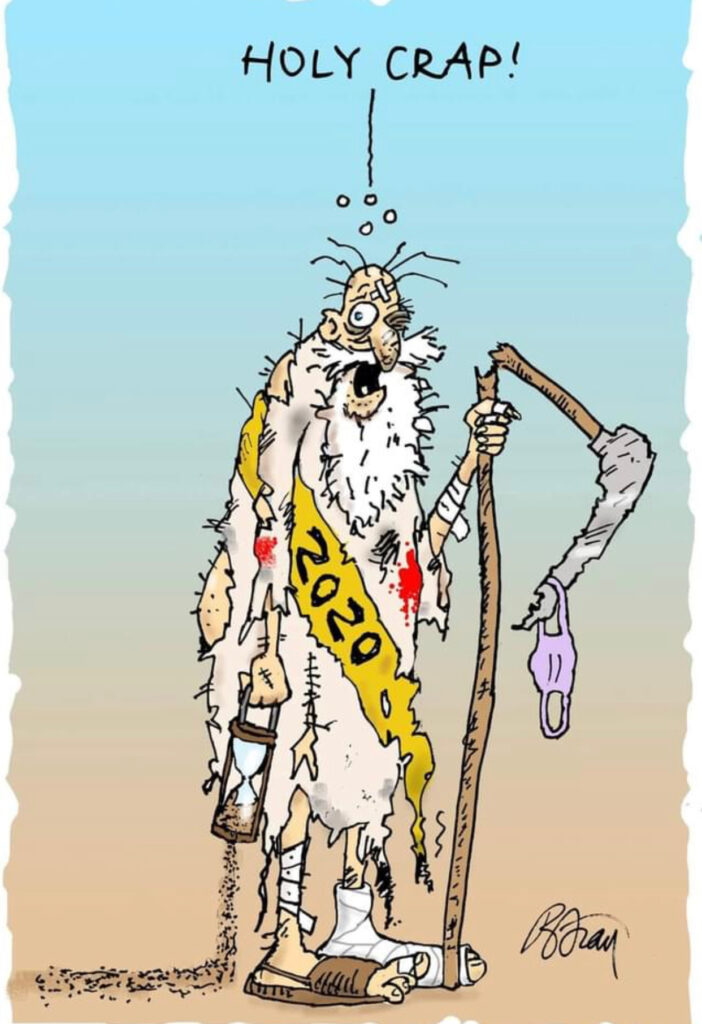

2020

Psychologically and emotionally, many of us slid into the end of 2020 on fumes, as ready as our friend above to be done with Covid-19, seclusion and quarantines. On a financial level investing in the stock market, however, it was a distinct dichotomy. While we may never see another global pandemic in our lives (knocking furiously on wood right now!), I also do not expect to ever witness a year of stock returns quite like 2020.

For three years now I have written about the “Digital Transformation”, researching and posting about the Cloud and SaaS (Software as a Service) companies of this digital transformation that are akin to those that flourished supplying the ‘picks and shovels’ of the Gold Rush in California in 1849. While the returns on these companies in the portfolio have dramatically outperformed all the indexes and averages for three years in a row from 2017-2019, the doors were absolutely blown off the hinges in 2020, accelerating to a whopping 202.6% return for the year. Put another way, that is tripling (3x) your original investment in one year! While that may seem incredible and even unbelievable, the far more impressive concept is when you compound the returns year over year for the past 4 years since 2017 to arrive at a cumulative return of 908.4% or more than a 10x return on your initial investment. The power of compounding returns is truly the 8th wonder of the world and quickly exemplifies how $1000 invested in year one becomes $10,084 in as little as 4 years; or $100,000 can become $1,008,400; if you remain vigilant, disciplined and…yes… get a little lucky! [Though I like to say, we create our own luck.]

While it was already transpiring before Covid-19, the way business is done throughout the world accelerated and was altered forever in 2020. The paradigm shift necessitated by the pandemic now requires almost every business to be cloud-first, and in some cases, all-cloud, or fail. While most of our portfolio companies have observed the acceleration to digital on their earnings calls, the actual proof of that acceleration has barely been realized yet in the results and growth of many of the companies providing the tools. Furthermore, in m any cases, even when the fundamentals of the company have surged, the stock prices have lagged behind that growth. I feel this is a huge opportunity going forward in 2021.

It is worth briefly comparing (“benchmarking”) the above extraordinary returns with some of the common stock indexes (below) that I track, if only to see how they compare to our portfolio. To be clear, one simply cannot expect an entire index of 500 or 2000 stocks (companies) in an index to come remotely close to outperforming 10 handpicked, incredibly fast growing, solid companies. It would be akin to suggesting that a random herd of ranch horses could come close to beating 10 genetically bred and trained thoroughbred race horses in the Kentucky Derby. Granted, you might get a couple horses in the index that perform quite well in a given year, but most will not be able to keep up the pace. That is why I personally don’t invest in indexes, in which at least 50% of the companies in that index are the bottom or worst 50%. It is not hard for me to look at 2000 companies and pick the 1000 that are performing better and thereby exclude the worst performers. Similarly, why not try to pick the best 10 companies and leave out the other 490 under-performers!

By all means, though, please don’t misunderstand me…it is still far better to invest in a stock index, than NOT to invest in the stock market at all. 100 years of history shows us the superior long-term average results of stocks….which are around 9.4% on average for 100 years.

2020 Index Returns

| Index | % Gain | |

| Dow | 7.2% | |

| S&P 500 | 16.2% | |

| Russell 2000 | 18.4% | |

| Nasdaq | 43.6% |

In summary, I fully expect the underlying stock prices of our portfolio companies not only to significantly outperform these indexes, but to continue to experience the acceleration in their company growth that has only just started. Moreover, I expect the stock prices of those best in breed companies to eventually catch up with and reflect those underlying fundamentals and growth. We have only seen the first wave of digital adoption and we are still only in the 2nd or 3rd inning.

Since I started closely tracking my monthly and annual returns, the returns on this primarily SaaS portfolilo of stocks have been nothing short of extraordinary. I fully expect this trend to continue to unfold and I am investing accordingly in 2021.

| CRWD | 20.15% |

| NET | 15.64% |

| DOCU | 13.80% |

| DDOG | 9.07% |

| OKTA | 6.48% |

| SNOW | 4.76% |

| ZM | 4.63% |

| ROKU | 4.04% |

| BPRMF | 0.99% |

| LSPD | 0.90% |

| EDIT | 0.49% |

Cheers and Happy New Year 2021!!

And if you use Twitter, please feel free to follow my twitter feed @VNunnemaker.